How to Earn $100 Per Month (or More) From Pfizer Stock (PFE)

Discover how to potentially generate a consistent $100 per month or more by investing in Pfizer stock. Craving a steady $100 monthly from stocks? Dividend-paying giants like Pfizer may hold the key. While no strategy guarantees success, PFE offers potential. Its consistent payouts could inch you closer to that extra income goal. Navigate the market’s complexities with precision. Analyze each aspect, divide resources widely, and investigate every component closely. Smart investing might just turn that appealing dream into a rewarding reality.

Understanding Dividends

To achieve your goal of earning $100 per month from Pfizer stock, understanding dividends is crucial. Dividends offer shareholders a slice of company profits. While quarterly payouts are common, timing can vary. A firm’s financial health and strategy determine the amount distributed per share. These payments reflect corporate performance and shareholder value.

Pfizer’s Dividend History

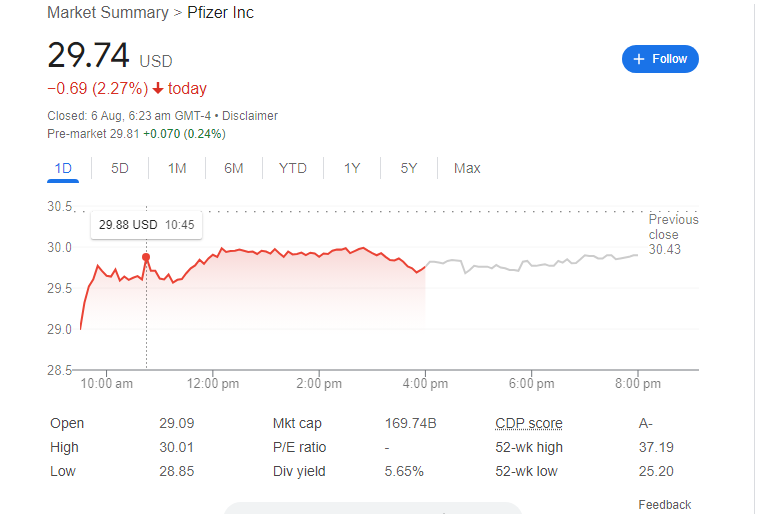

Pfizer’s dividend tradition spans decades. Today, shareholders reap a 4.1% annual yield. Each PFE share rewards owners with about $4.10 yearly. Steady dividends flow from Pfizer, unbowed by market whims. This reliable income stream attracts investors seeking stability. Through economic storms, the company’s unwavering payouts reflect a deep commitment to shareholders. Such consistency draws those craving portfolio resilience, underscoring Pfizer’s investor-focused ethos.

Reaching the $100 Monthly Goal

To earn $100 per month from Pfizer dividends, you’d need to own enough shares to generate that amount each quarter. Here’s the math:

- Target monthly income: $100

- Dividends per share per year (approx.): $4.10

- Dividends per share per quarter (approx.): $4.10 / 4 = $1.03

Number of Shares Needed:

To reach your $100 target, you’d ideally need to own enough shares to generate $1.03 x (number of shares) = $100. Solving for the number of shares, you get:

(Number of shares) = $100 / $1.03 ≈ 97.09

Since you can’t buy fractions of shares, you’d need to round this number up to 98 shares (or more) to achieve your goal.

Important Considerations

- Stock price fluctuations: Pfizer’s stock price can fluctuate, impacting the total investment required. The dividend per share might stay stable. But, you’ll need more shares if the price goes up.

- Dividend sustainability: Dividend stability at Pfizer remains uncertain. Future payouts hinge on the pharmaceutical giant’s fiscal fitness, potentially jeopardizing shareholder returns.

- Overall investment strategy: Don’t chase dividends alone.

Before investing in any stock, consider your:- investment horizon

- risk tolerance

- need for diversification

Alternative Strategies

- Dividend reinvestment plans (DRIPs): Pfizer and select firms offer dividend reinvestment plans (DRIPs). These programs can boost your income by converting payouts into extra shares. Over time, this compounding effect may significantly boost your investment returns.

- Fractional shares: Fractional investing opens doors for budget-conscious traders. Can’t afford a full share? No problem. Many brokers now offer slices of high-priced stocks. You can own a piece of the action without breaking the bank.

Predictions and Cautions

Predicting future stock performance with certainty is impossible. However, several factors could influence Pfizer’s stock and dividend prospects:

- Drug pipeline: Pfizer’s drug pipeline can affect its revenue and profits. This, in turn, impacts its dividend payouts.

- Economic conditions: Downturns can cut consumer spending on healthcare. This may hurt Pfizer’s revenue.

- Regulatory environment: Changes in healthcare regulations can influence the pharmaceutical industry, including Pfizer.

- Competition: Competition from other pharmaceutical companies can impact Pfizer’s market share and profitability.

Before investing, it’s vital to research and consider these factors. Diversifying your investment portfolio can help mitigate risks associated with individual stocks.

FAQs

Is $100 per month a realistic goal from Pfizer stock?

While it’s possible, no single stock can guarantee a set monthly income. Stock prices fluctuate, and dividends aren’t always stable.

How often does Pfizer pay dividends?

Pfizer issues dividend payments at three-month intervals.

What is the dividend yield of Pfizer stock?

As of August 5, 2024, Pfizer’s annual dividend yield is around 4.1%.

Can I invest in fractional shares of Pfizer?

Some brokerages allow fractional share investing. It helps if you can’t afford a whole share.

Are there any risks involved in investing in Pfizer stock?

Like any investment, there are risks involved. Stock prices can fluctuate. A company’s performance can affect its dividends.

Conclusion

Pfizer stock can be a part of a well-rounded investment strategy to generate income. Pursuing a specific monthly income target alone carries significant risks. Before investing, research the risks and your goals.

Disclaimer: Please note that the information provided in this article is a summary of the article’s content and does not constitute financial advice. It is important for individuals to conduct thorough research and consider their own financial circumstances before making any investment decisions.

Explore Bizzvista.com for broader financial insights